Feeling like “the tax man cometh” too often?

With a recent notice from the IRS that the tax filing deadline has been pushed back to May 17th, you may be feeling a little off the hook for now. The pressure is off, at least for the moment. However, while there is a momentary lull in the action, consider a few facts about taxation which might make you think about taxes differently.

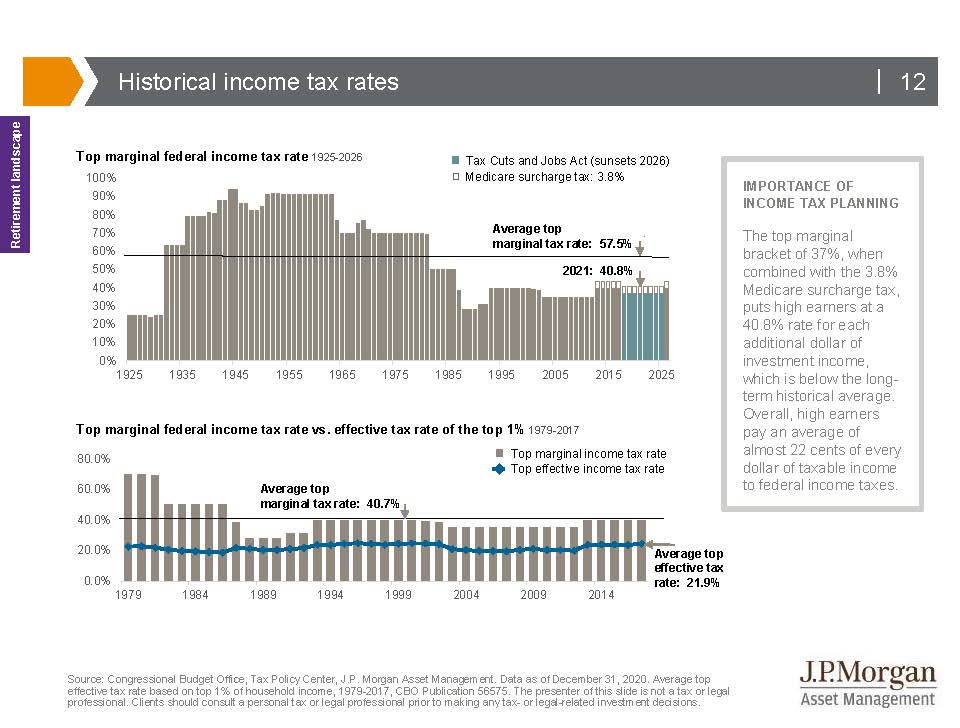

Historic Tax Rates

While it’s easy to feel like you are paying too much in taxes, especially at this time of year, it’s important to put this in perspective. In 2021, the top marginal tax rate is 40.8%, which is a combination of the top marginal bracket of 37% and the 3.8% Medicare surtax for high earners. That sounds like a very high tax rate but consider that the historic average top marginal tax rate (1925-2026) is 57.5%, with rates in the 1950’s topping 90%. The marginal tax rate considers the highest tax bracket you hit with your taxable income, while the effective tax rate is the percentage you are effectively paying when your income across all those brackets is considered. The U.S. has a progressive tax rate, where the first dollars are taxed at lower rates. As you fill up tax brackets, portions of your income are taxed at higher percentages. Using the latest data available, the average top effective tax rate is 21.9%, meaning that high earners on average are paying 22 cents of every taxable dollar to the IRS.

If we look at the top chart above, you can see that the top marginal tax rate is not high in terms of historical rates. We do know that the current rates will change (increase) in 2026, unless tax legislation is passed to adjust them sooner. What this means for tax planning purposes is that we have a current environment of lower tax rates, even for high earners. The window for these lower rates may close sooner than 2026 depending on legislation, but regardless, there is limited time to take advantage of it.

What should be considered to make good use of current tax rates?

Even though we all dislike paying taxes, taking action now might be advantageous in the long run.

- Consider Roth conversions of tax-deferred IRA money.

- Put more into the Roth portion of your 401k as part of your overall deferral, even though it will likely increase the taxes you pay today.

- Capture capital gains on long term holdings in your brokerage accounts. These are currently tax-favored with rates lower than ordinary income rates. The ability to take advantage of this favorable tax treatment may expire sooner than the 2026 date mentioned earlier.

- Make non-deductible contributions to a regular IRA and then convert those to Roth IRAs. This strategy can be employed if your income is too high to allow a direct contribute to a Roth IRA.

In some cases, you can still affect your 2020 tax filing, through direct Roth IRA contributions or #4 above. Otherwise, talk with your advisor about how these suggestions might fit into your 2021 planning, to take advantage of historically lower rates and be better prepared for where rates are headed in the future.