Russians and Fed Chiefs and Covid, oh my!

Well, we have certainly turned a corner as 2021 ended and 2022 has begun. Now that we are a month into the new year, let’s take a moment to see what’s different since we left 2021 behind.

One thing that hasn’t changed is that we are still dealing with Covid and most of us are weary of the restrictions. After a few months of relative freedom from Covid’s lockdown during the summer and leading up to Thanksgiving, Omicron emerged. The variant spreads easily but isn’t as debilitating as earlier variants. This has led to fewer negative economic impacts and a view held by some that we need to begin living with future Covid variants more like a seasonal flu virus. One sidenote for portfolios; if China sees their infection rates increase steeply with Omicron or future variants, their zero-tolerance policy may result in factory shutdowns and put further strain on the already burdened supply chain issues.

2022 brought the Federal Reserve decision-making on interest rates to the forefront, as they work to reconcile increasing inflationary pressures with their stated policy goals. The Fed has sought to be very transparent about upcoming actions to help avoid surprising the markets, but despite this, the markets have become increasingly unsettled as rate increases and tightening of money supply begin.

Geopolitically, rising tensions between Russia and NATO over Ukraine raise concerns about energy availability, armed conflict between nations and the status of US/Russia relations. Armed conflicts are unsettling to markets and could also result in European energy shortages and price spikes if Russian supplies are cut off.

We are only a month into the year and the markets have declined due to the uncertainty. We officially entered a correction (10% decline) in both NASDAQ and the Russell 2000 during January. It is important to remember that corrections are a normal part of market movements, with a correction expected every 18-24 months. In portfolios, growth and technology holdings saw the largest declines but these are the same holdings which helped boost the performance of the S&P 500 to 26.9% for 2021. 1

While no one likes to watch the value of a portfolio decline in such a quick manner, there are several considerations which are important to remember.

- A well-diversified portfolio helps to protect your assets in rapidly declining markets like we’ve seen in the past few weeks. While growth assets have declined more significantly during this period, value assets have held up much better. Clearview’s equity tilt toward value has been somewhat protective in the current environment.

- The level of equity risk in your portfolio is tied to your asset allocation and risk profile. This means for those who have a balanced portfolio, only about 50% of the portfolio is exposed to equity market risk. Therefore, when you listen to the news and learn that the DOW was down 400 points or NASDAQ declined 3% in a single day, your portfolio is likely not experiencing the same levels of decline. Additionally, your fixed income is anchoring the portfolio and provides stability throughout this time.

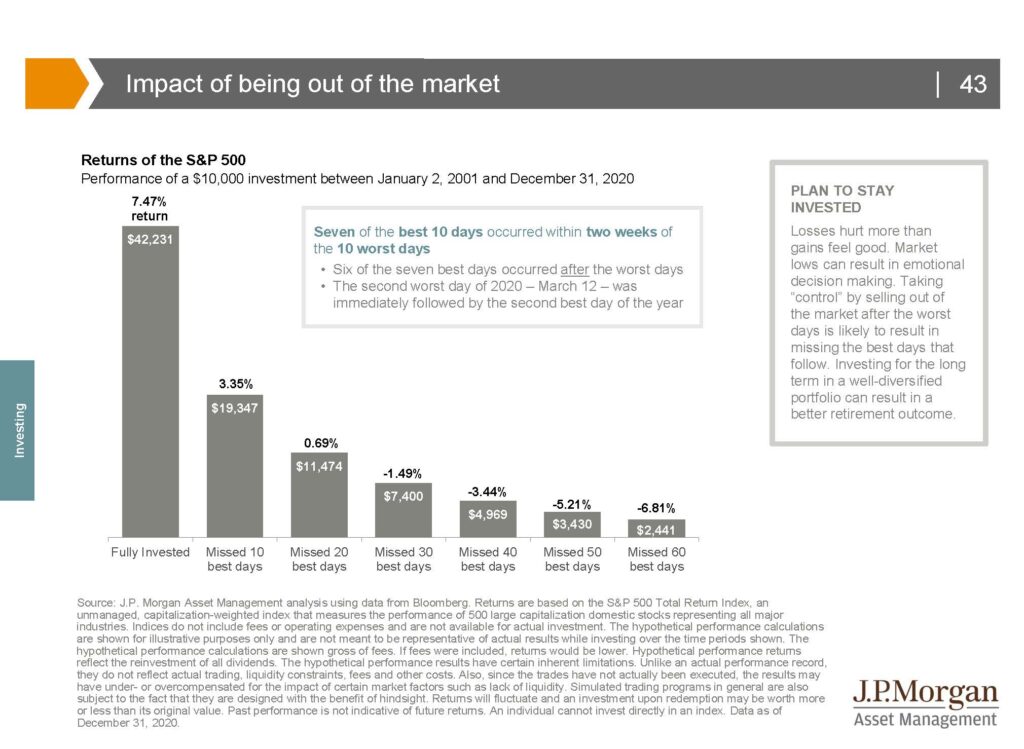

- History shows us that markets will recover from these corrections, sometimes very quickly. However, history also shows that those who panic during these corrections and move to cash, sometimes sacrifice long-term positive returns. The chart below shows the drastic reduction in return because of missing out on recovery day.

Finally, a word about market volatility. While it can be uncomfortable, it is an essential part of healthy markets. It creates the possible opportunity for investing in quality companies at a discount (on sale!) and allows investors to put sidelined cash to work for the long-term. For most clients, even those in retirement, if adequate cash and fixed income are held in a portfolio to ride out the days of volatility, they (clients) can avoid realizing actual losses at inopportune times.

Just a note to say that in the last week, returns in growth and tech have reversed, with positive returns and a recovery of some of the prior week’s declines. A lesson in staying invested and diversified because you never know when the markets will turn.

Clearview actively evaluates your portfolio holdings to ensure they are reacting in expected ways when markets are volatile. Clearview is also always looking for quality, long-term opportunities to invest in for the future. If you have specific questions about your portfolio, please contact your advisor to set up a time to meet and discuss.

1 – Source: Morningstar